A newly released report from the Arizona Auditor General has unveiled what appears to be a massive financial fraud allegedly orchestrated by former Santa Cruz County Treasurer Elizabeth Gutfahr, who is accused of embezzling over $39 million from county funds over a ten-year period. The report details a series of unauthorized transactions, falsified documents, and systemic failures in financial oversight that allowed the fraud to continue unchecked.

Republican State Senator Matt Gress told The Arizona Sun Times, “The level of deception involved is staggering.”

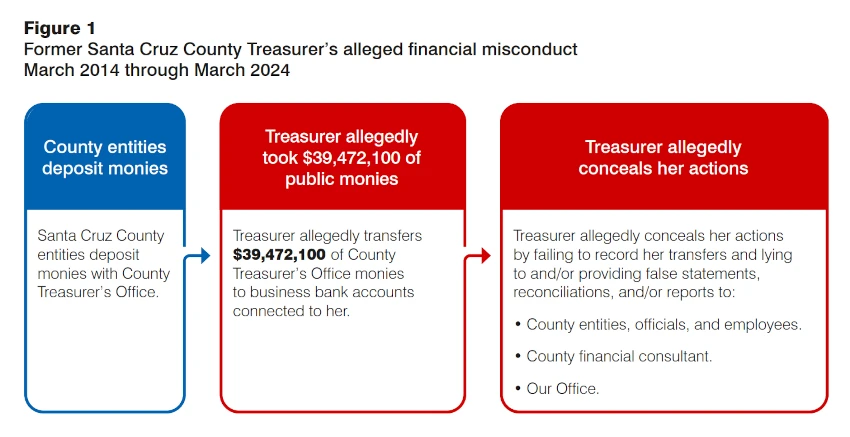

The Auditor General’s report details that from March 2014 to March 2024, former Treasurer Elizabeth Gutfahr allegedly conducted 182 unauthorized wire transfers, siphoning $39,472,100 from two county bank accounts into business accounts linked to her. “To help conceal her actions, the Treasurer allegedly failed to record her unauthorized wire transfers in the County Treasurer’s accounting system and lied to and/or provided numerous false investment statements, cash reconciliations, and Treasurer’s Reports to County entities, officials, and employees; a County financial consultant; and/or the Arizona Auditor General (Office),” the report states.

The Auditor General’s office noted in its report, “Gutfahr allegedly created false investment statements from the investment banking company UBS… [showing] a nonexistent $14,000,000 balance in 2021.” The report also said that the fraudulent activity escalated over time, with reported balances inflating to $17.2 million in 2022 and $26.5 million by 2023.

The report also criticized the lack of effective oversight by the Santa Cruz County Board of Supervisors. Despite their responsibility for monitoring county finances, the report found that some supervisors were unaware of the contents or purposes of the financial reports they were supposed to review. As a result, irregularities in the treasurer’s reports, such as the repeated use of the same investment balance figures across multiple months, went unnoticed. “If the Supervisors had seen the reports, they might have noticed that Gutfahr did not even bother to change some of the figures on the value of certain investments and checking accounts from month to month,” the report pointed out.

Under ARS Section 11-251, the County Board is responsible for supervising the treasurer.

According to the Auditor General’s report, the scheme began to unravel in April 2024 when JPMorgan Chase Bank’s anti-money laundering team flagged suspicious activity. Specifically, the bank identified multiple outgoing wire transfers from the County Treasurer’s Office money market savings account to business bank accounts linked to the Treasurer. The bank “notified the County that its anti-money laundering team had flagged the County Treasurer’s Office money market savings account due to multiple outgoing wire transfers to 2 business bank accounts connected to the Treasurer.” The total amount flagged by the bank was $4,550,000, which prompted further investigation.

This alert from Chase Bank led Santa Cruz County officials to take immediate action. The report noted, “The County took corrective action the next day by removing the County Treasurer’s Office authorized signatories from all County Treasurer’s Office bank accounts, replacing them with the County manager and County board of supervisors chairman.” Subsequently, the County Board of Supervisors accepted the Treasurer’s resignation after informing her of their intent to suspend her due to these irregular and suspicious financial activities.

The report highlights several alarming aspects of the scheme, including the Treasurer’s ability to bypass internal control measures by obtaining unauthorized access to multifactor authentication devices and passwords from other County employees.

The Arizona Auditor General’s report reveals that several employees in the Santa Cruz County Treasurer’s Office admitted to receiving personal financial assistance and gifts from former Treasurer Gutfahr.

One of the key admissions per the report came from the chief deputy treasurer, who acknowledged receiving a $6,000 “loan” from Gutfahr to purchase a new air conditioner, which she plans to repay upon retirement. Additionally, the chief deputy confirmed that Gutfahr provided her with a car valued at $3,000 for her sister’s use and has been covering her personal cell phone expenses since 2019 or 2020.

Similarly, the senior secretary disclosed that Gutfahr had paid her personal bills on occasion, gifted her children $100 each on their birthdays, and gave her $1,500 for her own birthday the report detailed.

Another employee, a tax clerk, reported that Gutfahr had given her son a “generous” wedding gift, hosted her daughter’s wedding at Gutfahr’s ranch, and even accompanied her on a weekend trip to San Carlos, Mexico, per the Auditor report.

Recommendations:

In light of these findings, the Arizona Auditor General’s report offers several recommendations aimed at preventing similar incidents in the future. These include:

- Implementing stricter internal controls within the County Treasurer’s Office.

- Ensuring that financial records are accurately recorded and regularly reconciled by multiple independent employees.

- Providing ongoing training for County employees on internal control procedures.

- Conducting unscheduled compliance audits to verify adherence to financial procedures.

Additionally, the report suggests legislative action to grant the Auditor General’s office direct access to financial institution records and to mandate minimum training requirements for newly elected or appointed county treasurers and their deputies.

In response, Gress (picture here) has vowed to introduce immediate reforms to prevent such egregious misconduct in the future. “This case is a glaring example of what happens when oversight fails,” Gress said in a statement. “It’s imperative that we equip our state agencies with the tools they need to protect public funds.”

Gress expressed his deep concern in an interview with The Sun Times, calling the situation a “massive betrayal of public trust.” He elaborated, “This wasn’t just Santa Cruz County; she managed the accounts of fire districts, school districts, and the jail. The misuse of funds could potentially jeopardize all of these entities.” Gress emphasized the gravity of the situation, stating, “The breadth and depth of this is deeply disturbing. We will monitor this very closely.”

Gress also expressed his hope that federal authorities will take decisive action. “I hope the FBI pursues this vigorously and that those who commit wrongdoing are brought to justice,” he said.

The FBI is actively investigating the case, and Gutfahr, who is facing both civil and criminal charges, recently appeared in court. The next hearing is scheduled for September 20, 2024.

Read the full report:

– – –

Christy Kelly is a reporter at The Arizona Sun Times and The Star News Network. Follow Christy on Twitter / X. Email tips to [email protected].